Compare Just Eat Food Car Insurance

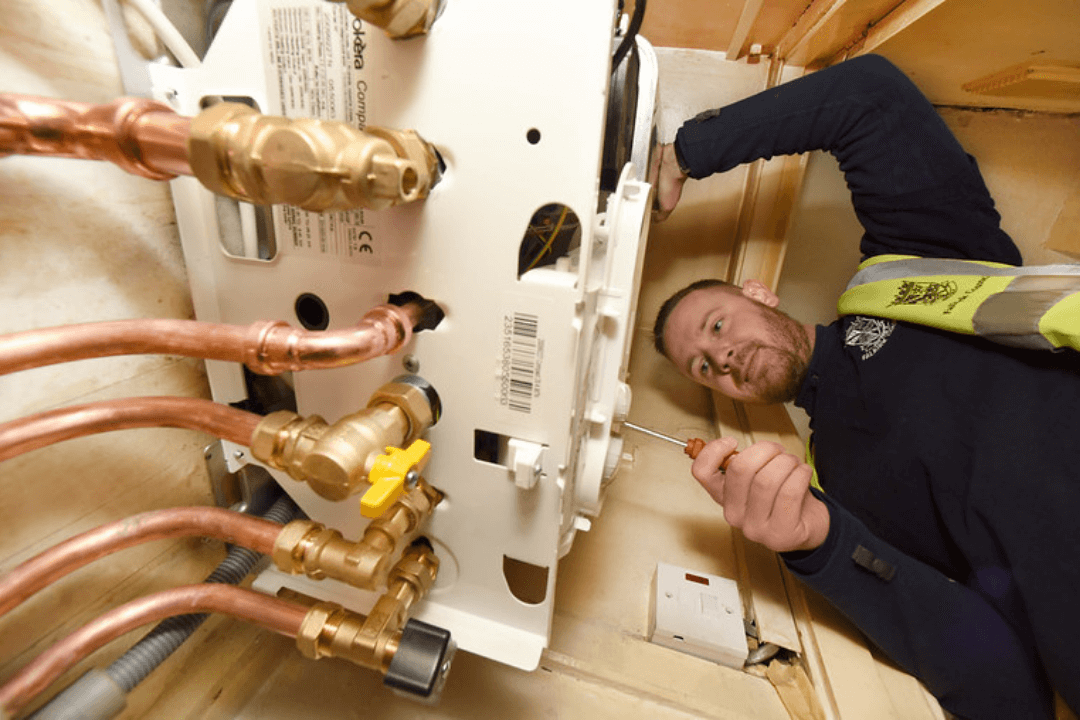

You’re responsible for maintaining clients’ property, which means you and your business need insurance protection, just in case anything goes wrong. Not having the right type of coverage means you and your business would be responsible for any claims. Can you afford to pay such expenses out of pocket?

What Types of Insurance are Available for Property Maintenance Coverage?

There are several, but there are two types of insurance that are essential for your business:

Public liability insurance: this type of coverage protects you against injury or damage to property to your client or a third party.

Employer’s liability insurance: which is a legal requirement if you have employees.

Professional indemnity insurance: this type of coverage protects you in case you’ve offered the wrong advice, services, or designs that cause a financial loss to your client.

What is Property Maintenance Insurance?

This is a type of coverage that protects you and your business. You face certain risks every day. Just one mistake could lead to an expensive claim. This is what property maintenance insurance protects you from.

What would happen if you installed the wrong fence, for instance? For one thing, you’d have a very unhappy client. Chances are they would be so unhappy that they may file a claim against your business. Claims of this type can be extremely expensive. In fact, claims can be so large that they can financially cripple you and your business. Your business may even be forced to close forever.

While public liability insurance isn’t legally required, wouldn’t you feel better knowing you and your business are protected from claims that could financially cripple you and the company?

Save yourself time and money. Compare Just Eat Food Car Insurance today

Just Eat Food Car Insurance FAQs

Do I Need Employer’s Liability Insurance for One Employee?

Yes, you’re legally required to have this type of coverage for one or more employees. The legal minimum required is £5 million.

What If I Have No Employees? Am I Still Required to Have Employer’s Liability Insurance?

If you don’t have any employees, then you may not need employer’s liability insurance. However, if you hire subcontractors, voluntary or casual workers, then you may want to consider this type of coverage. It would protect them in case they’re injured or become ill while working for you.

What If I’m Self-Employed? Do I Need Employer’s Liability Insurance?

If you’re self-employed and have no employees or workers, then you’re not required to have this type of policy. However, you may need employer’s liability insurance if a client requires it for a specific project.

Do I Need Employer’s Liability Insurance for a Limited Company?

Yes, if you have a limited company and one or more employees, or if you have more than one direction, you’ll need this type of coverage.

In addition, you’ll need employer’s liability insurance even if you employ close family members and your company is incorporated.

Do I Need Employer’s Liability for Temporary Workers?

If you have short-term staff, contractors, or casual worker, then you will probably be required to have this type of policy.

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.