Compare Takeaway Delivery Driver Insurance

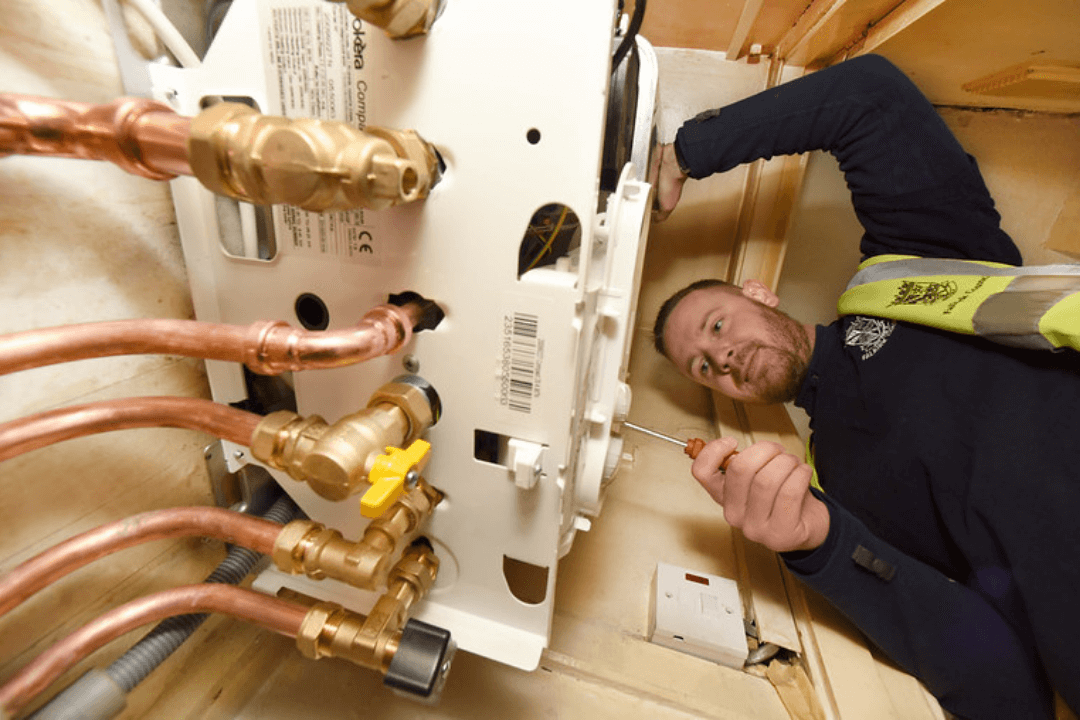

Your work involves keeping clients, their homes, and businesses safe through the installation of home alarms or CCTV systems, you keep people and their things safe. As you work, it’s also important to keep your business safe.

Why Does Your Alarm Installation Company Need Business Insurance?

No matter if you’re self-employed or are a larger business, insurance can keep your business safe. What would happen if a system install was done incorrectly and didn’t work to protect the client? Chances are high you’d have to deal with a large claim and legal fees. Could your business afford to pay for these out of pocket? Just think, one claim could put you out of business for good.

On the other hand, business insurance would pay these expenses for you. With public liability insurance, you’ll be protected against injury or damage caused by your business operations. Professional indemnity insurance coverage will protect you against these types of claims.

What Types of Insurance Coverage are Available for an Alarm Installation Company?

You have a variety of insurance coverage available for your business.

Professional indemnity: includes £1 million of insurance protection that covers designs, advice, and recommendation you may provide to a client. If these cause a financial loss for your client, your business is protected.

Public liability insurance: offers coverage up to £5 million if a third-party is injured or their property is damaged due to your business operations.

Employer’s liability insurance: if you have employees working full-time, part-time, volunteers, or even apprentices, then you’re legally required to have employer’s liability insurance. This protects them on the job in case they’re injured or become ill.

Van insurance: this type of coverage protects your van. It offers accident recovery, roadside repairs, and a guaranteed courtesy van. You’ll be able to stay on the job even if your van has mechanical trouble.

Save yourself time and money. Compare Takeaway Delivery Driver Insurance today

Takeaway Delivery Driver Insurance FAQs

How Much Does Alarm Insurance Cost?

Your insurance premium will be based on various factors. In fact, you’ll be able to create a bespoke insurance policy that meets the needs of your unique business.

Can I Insure my Tools?

Yes, your tools can also be insured. You can choose from a couple of different policies:

- Hired in tools and plant insurance: this covers hired or rented tools. They will be protected against damage, accidental loss, or theft.

Own plant tools and equipment: this type of insurance policy protects the tools you own against loss, theft, or accidental damage.

Do I Need Employer’s Liability Insurance for One Employee?

Yes, this is a legal requirement. You must have employer’s liability insurance for one or more employees, at a minimum of £5 million.

What If I Have No Employees? Do I Still Need Employer’s Liability Insurance?

If you have no employees, then you may not need to have this type of coverage. However, if you subcontract, hire voluntary or casual labor, then you should have employer’s liability insurance. This way, these workers will be protected on the job if they become ill or injured.

What our customers say about us

Our support does not end with the purchase of your cover. We are here to support you when you need us.

If you have questions or would like to update, or renew your policy, all you have to do is contact us. We will also help if you need to make a claim.

Jason Mitchell

Very easy & uncomplicated online comparison, easy & very competitive prices for fully comprehensive insurance for our gas business, very fast delivery of email confirmation of your policy, very efficient indeed you must try these for a smooth, quote and buy transaction, no more being bombarded with telephone calls from brokers.

Andy Harrow MD

Easy and simple form to complete, step by step, then gave me a number quotes from a number of insurers, then allowed me to purchased there and then, covered and an email sent straight away with my policy documents, Thanks again, highly recommended. Andy

Marshall & Sons

My renewal was due to expired so I used Mybusinesscomparison's quote and buy service. This made the whole process painless.

I recommend this company for quality service and confidence you are properly insured.